Solar Tariffs Hiked by Trump: How Do They Affect Solar Industry Dynamics?

Over the past decade, the U.S. solar industry has witnessed rapid growth as solar power has become the popular choice of homeowners and businesses looking to lower high energy bills and achieve power independence. However, the recent solar tariff hike named the “Liberation Day Tariff” by President Trump may lead to new challenges for the solar industry and homeowners in terms of the costs of solar, supply chains, and installation processes. As per new tariff policy, a 10% duty will be imposed on all imported products. However, the countries having trade imbalance with the U.S. will face higher rates like a 125% tariff imposed on Chinese imports while Vietnam, Malaysia, Thailand and Cambodia are expected to face 36%-49% higher rates.

According to the National Renewable Energy Laboratory Solar Industry Update, the U.S. has imported nearly 48.5 GW of solar panels in 2024. Many U.S.-manufactured solar panels are made up of imported components including solar cells or other materials, sourced from countries affected by these elevated tariffs. Initially, the aim behind imposing tariffs on solar panels was to support local manufacturers to grow in the market. But now the recent tariff extension is creating complexities for the solar industry, especially for homeowners in terms of affordability.

To help you understand the recent tariff policy and its impacts, we will break down the history of solar tariffs and their consequences and also share some smart tips for homeowners to protect themselves from the increasing cost of solar.

To help you understand the recent tariff policy and its impacts, we will break down the history of solar tariffs and their consequences and also share some smart tips for homeowners to protect themselves from the increasing cost of solar.

What are solar tariffs?

A solar tariff is a surcharge or tax that a country imposes on different kinds of solar equipment imported by foreign manufacturers. It often includes panels, solar cells, module components, and the raw materials required to make solar panels. This tax raises the buyer’s cost, which encourages customers to purchase from domestic manufacturers. As solar cell tariffs add extra cost to importing solar panels from other countries, people may prefer to buy equipment from domestic manufacturers. The high solar tariffs provide an opportunity for U.S. manufacturers to become competitive in the industry while still adhering to strict labor standards and employing U.S. workers. So, the purpose of imposing tariffs on solar panels is to boost domestic revenue and create more jobs.

A Brief History of Tariffs in the Solar Industry

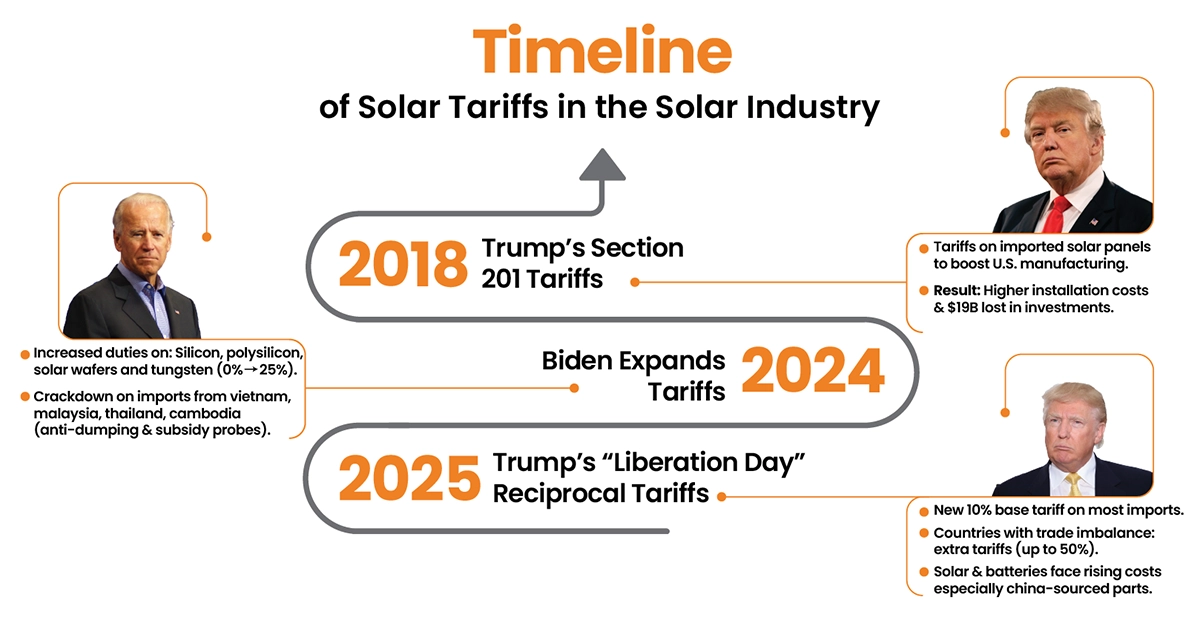

Tariffs on imported goods are not new to the solar sector. In 2012, President Obama’s Commerce Department imposed the first tariffs on Chinese solar panels ,imposing 24%–36% duties. The purpose of these taxes was to protect American solar companies from significantly low-priced imports. However, U.S. solar manufacturers still found it difficult to make panels at prices competitive with Chinese products.

Solar Tariffs under Trump’s First Administration

In 2018, implementing tariffs was the major component of the first Trump administration’s trade strategy. To support American producers, Trump levied Section 201 tariffs on solar panels. Although it boosted the manufacturing of solar panels in the United States, residential installation costs increased as well. The solar industry experienced a 128% surge during President Trump’s first term, reaching 100 gigawatts (GW) of installed solar. However, the Solar Energy Industries Association (SEIA) claims that there are some negative impacts of this solar tariff. It includes higher costs of solar installation and $19 billion loss in new private sector solar investment.

Biden Administration & Tariffs on Solar

Former President Biden further increased the tariffs imposed during the Trump administration. He raised Section 201 duties on several Chinese solar products in 2024. Many solar components, including silicon included in this increase under the CHIPS Act. Moreover, at the year’s end, the U.S. Trade Representative announced a 25% hike in polysilicon and solar wafers made in China. Also, duties on specific tungsten items increased from 0 to 25%, effective January 1st, 2025. In 2024, the Biden administration also conducted countervailing duty investigations and enforced anti-dumping legislation in major solar manufacturing countries, including Vietnam, Malaysia, Thailand, and Cambodia. The purpose of the policy is to prevent foreign solar panel manufacturers from oversaturating the American market.

Liberation Day Reciprocal Tariffs by Trump in 2025

President Trump imposed “reciprocal tariffs” on almost all US imports on April 2 (except a few items, such as semiconductors and pharmaceuticals). The base tariff rate is 10%. However, for the countries having trade imbalances with the U.S., the rate is 50% of the trade deficit. The new tariffs will increase the cost of solar equipment and battery storage systems. Battery components are mostly sourced from China and therefore are subject to additional taxes even if the final assembly is completed in the United States.

What are the impacts of solar tariffs on solar industry?

The new tariffs on solar panels and accessories are the talk of the town these days. Let’s have a look at how it is changing solar industry dynamics:

Tariff Loophole Closure:

The Trump new policy has stopped Chinese companies from shipping imported products through Southeast Asian countries to avoid tariffs. In fact, a 49% duty is imposed on Vietnam, Malaysia, Thailand, and Cambodia imports that supply over 80% solar panels and other components in the United States.

Solar Industry Reaction:

Solar Energy Industries Association (SEIA) predicted cancellation of up to 25% solar installations due to new tariffs on solar. Also, due to domestic supply chain adjustments, Wood Mackenzie predicted a potential slowdown of 18-months in the solar market. Moreover, the industry leaders are arguing that there are more negative impacts of this new policy. Many solar advocate groups like SEIA are planning to legally challenge the Trump tariff policy for violating World Trade Organization rules and restraining clean energy initiatives.

How will new solar tariffs impact residential solar system costs?

The cost of installing solar is expected to rise in 2025 due to new and increased tariffs. Higher tariffs on solar products manufactured in China may result in higher production costs and short-term inventory shortages. Moreover, American companies will have to struggle to stabilize the supply chain and meet consumer demand if foreign companies reduce imports of solar equipment.

Moreover, there is a significant impact of rising solar tariffs on the growing battery storage and EV market. The essential battery and EV components like lithium -ion cells, cobalt, graphite are mostly sourced from China. With increasing import duty, the cost of these components will also increase and become challenging for homeowners and businesses to afford these solar solutions.

Additionally, these tariffs are not only impacting the home or commercial solar market but also the utility scale projects. Due to cost hikes, the solar providers have already warned about cancellations and delays of utility projects. For cost effective options, many large solar projects depend upon imported components but now the rising import duties will not only slow down the process but also restrict many utilities to utilize clean power.

How homeowners can protect from the impacts of new solar tariffs?

Despite the new tariffs on solar panels and increasing solar equipment costs, there are still smart ways to switch to solar affordably. Here are some useful tips if you are planning to go solar now:

- The prices of solar equipment are expected to rise with the implementation of new tariffs. However, you can still lock in low rates if you immediately plan your home solar system installation. There may be some trusted solar installers who have stocked inventory before the new tariffs. So, if you sign up with them, they may offer you competitive pricing.

- Choosing U.S. solar products is another smart way to reduce the effects of solar tariffs on your solar investment. Many solar companies manufacture and assemble high-quality solar panels domestically, which leads to fewer tariff impacts.

- The good news is that the federal tax credit is still effective and can offset your solar installation cost by 30%. Additionally, you can benefit from local solar incentives and rebates to further lower your expenses. But it is important to plan quickly, as these advantages may also change with new policies.

- You can also consider solar financing options to make solar affordable. Options such as solar loans, leases, or PPAs help you to go solar with low upfront costs. Consult with a local solar installer for an expert opinion about the best option for you.

- It is also suggested to compare multiple quotes from multiple local solar installation companies near you for the best deal.

On the whole, although new solar tariffs hiked by the Trump Administration are quite challenging for the solar industry as well as for solar customers. However, with the rising electricity costs and frequent power outages, solar is still a worthy investment. You can still benefit from all solar incentives by planning your solar installation quickly. Also, going solar with a trusted local solar installer like Solar SME can help you achieve higher ROI even in an increased tariff era.

So, book a free consultation with Solar SME to explore the best options for your home and business. With our smart solar calculator, you can get an instant analysis of your potential solar savings. Start your solar journey before the new price hike and incentives expire!