Maximize Savings with

Solar in New Mexico

Clean Power, Lower Costs, and Big Incentives!

Our Location:

Call Us!

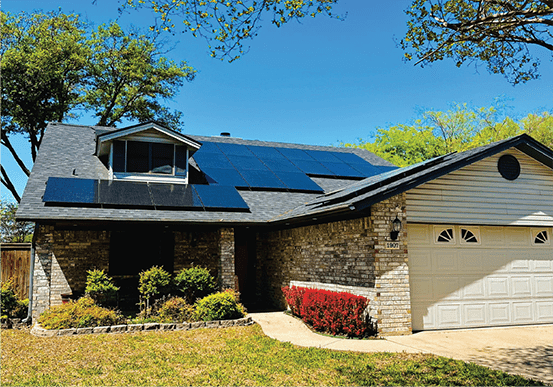

When it comes to annual sunshine hours and solar energy potential, New Mexico ranks among best. At number 14, it is in the top half of all states for the generation of solar electricity, so it is not an exception to the trend of solar installations becoming more and more popular in recent years. New Mexico offers extra benefits to significantly offset the upfront expenses of the solar system, even if the return on investment in solar energy relies on how much sunlight your home receives and your energy usage habits. New Mexico has an average electricity price of 14.03 cents/kWh, according to the latest data from the U.S. Energy Information Administration. Considering this tariff, 11,000 kWh of solar generation can save you up to $1,543 per year.

For many people, going solar in New Mexico is a wise investment because of policies like net metering, sustainable building tax credits, property tax exemptions, and state solar tax credits in addition to the federal solar tax credit. Let’s have a look at the solar incentives in New Mexico to reduce the upfront cost of installing solar and make solar energy affordable for New Mexicans.

New Mexico Solar Incentives

If you live in New Mexico, you may take advantage of several incredible rebates that can significantly increase the return on your solar panel investment. These tax credits are among the most effective methods to reduce your solar energy expenses.

Residential Clean Energy Credit

You can cut the cost of your solar panel installation by 30% with the help of the Residential Clean Energy Credit, formerly known as the Federal Investment Tax Credit (ITC). This incentive applies to your complete system, including labor, permits, sales tax, and equipment. You can claim this incentive as a credit toward your federal tax bill when you file your federal income taxes. Just remember that leasing a system would exclude you from the ITC; you must pay cash or obtain a solar loan to purchase your system.

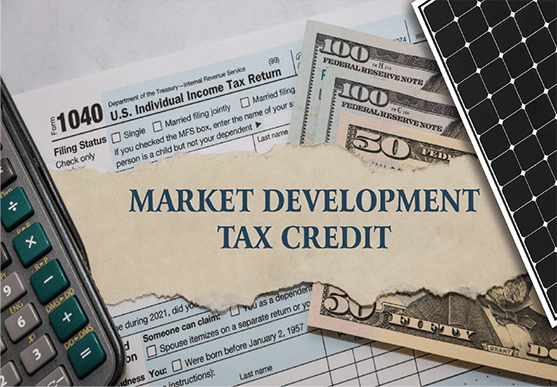

Solar Market Development Tax Credit

Solar owners can receive a tax credit of up to $6,000 through the SMDTC, which is equal to 10% of the cost of labor, materials, and equipment for a solar energy system. To qualify for this tax credit, you need to get approval for your solar energy systems from the Energy, Minerals, and Natural Resources Department (EMNRD) of New Mexico. The financing is set at $12,000,000, which means that applications will not be accepted for that year until the state grants $12,000,000 in tax credits.

Sustainable Building Tax Credit (SBTC)

If you install solar on your home as part of your sustainable building efforts, you can receive a tax credit through the Sustainable Building Tax Credit (SBTC). Your home must have a U.S. Green Building Council sustainable certification to be eligible, and the credit’s worth is based on the degree of your certification. The Solar Market Development Tax Credit (SBTC) cannot be claimed with solar panel installations that are utilized to claim the SMDTC.

New Mexico Solar Property Tax Exemption

Your property’s value will rise with the installation of a solar system, but there won’t be any additional tax costs. Any newly installed solar energy system in New Mexico is free from property tax assessment due to the Renewable Energy Property Tax Exemption. This substantial incentive may reduce the time until you begin to earn a net positive financial return and help you recoup the cost of your solar system.

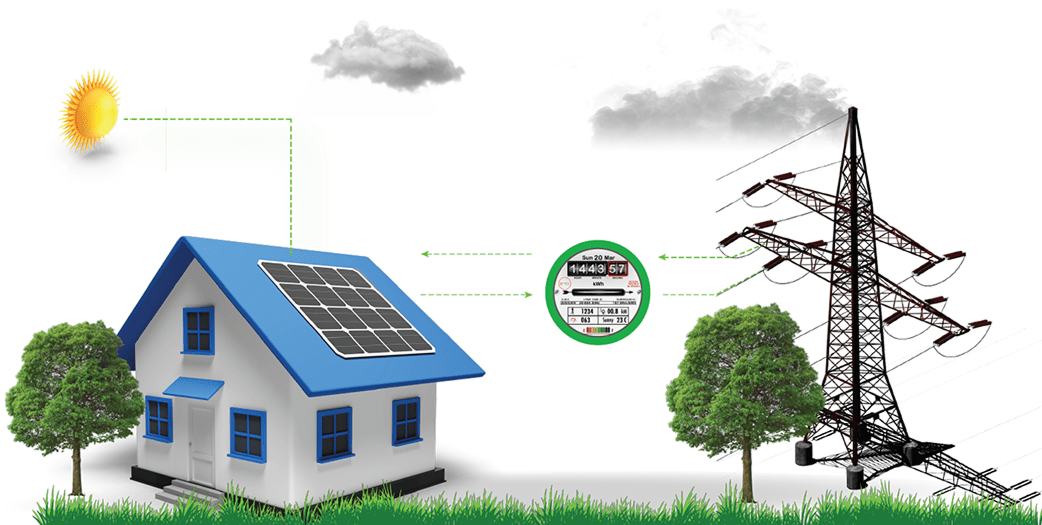

Solar Market Development Tax Credit

One of the best solar panel incentives in New Mexico is net metering. In New Mexico, regulated electric companies are bound to enable net metering for solar panel systems under 10 kW, while municipal utilities are not required to offer it. Up to 100% of your utility’s electricity usage, you will receive credits under New Mexico’s net metering program, valued at the retail rate of electricity for each kWh of electricity your system generates. You will receive credit for your surplus generation at the avoided cost rate if you supply the grid with more electricity than you consume.

Solar SME Installation Services in New Mexico

Explore your Solar Savings in New Mexico!

Frequently Asked Questions

You should know how much energy your household uses on average each day before switching to solar power. You should also research the type of solar panels you will need, as high-efficiency solar panels will produce more energy each day, and you can store that energy in a home battery backup if necessary.

Efficiency, yield, warranty options, durability, and aesthetics (which may involve your Homeowners Association) are all important factors to take into account before investing in a solar panel system. We offer highest quality panels and accessories that are covered by performance, product, and workmanship warranty.

Efficiency, yield, warranty options, durability, and aesthetics (which may involve your Homeowners Association) are all important factors to take into account before investing in a solar panel system. We offer highest quality panels and accessories that are covered by performance, product, and workmanship warranty.

It’s essential that you consider your roof’s dimensions, shape, and slope. Although other roofs might work, south-facing roofs with a slope of 15 to 40 degrees are usually the ideal for solar panels. The age of your roof and when it will need to be replaced should also be taken into account.

Indeed, a house can be powered entirely by solar energy with a home solar panel system that also includes a battery backup. You could easily produce enough energy to power your house and everyday necessities with high-quality solar panels and a high-quality battery.